Car title loan identity verification involves rigorous document and background checks to confirm borrowers' identities and vehicle ownership, ensuring regulatory compliance, mitigating fraud risks, and fostering transparent, mutually beneficial loan agreements in Fort Worth. Unique cases may require additional documentation.

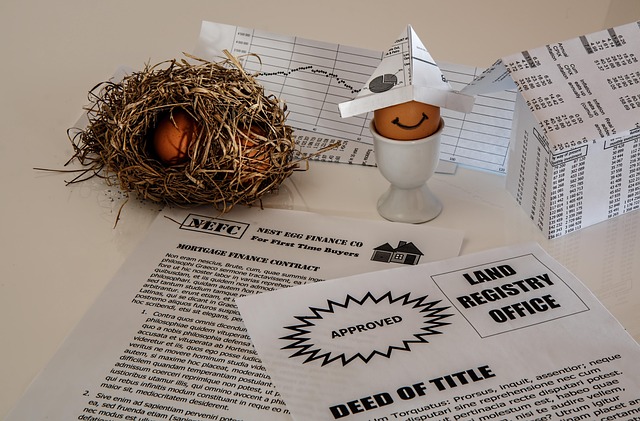

Car title loans, a popular alternative financing option, require robust identity verification to meet regulatory standards. Understanding and implementing effective car title loan identity verification processes are crucial for lenders to mitigate risks and maintain compliance. This article delves into the intricacies of this process, highlighting key components and benefits for both lenders and borrowers. By ensuring accurate and secure verification, lenders can enhance their operations, while borrowers gain access to needed funds with peace of mind.

- Understanding Car Title Loan Identity Verification

- Key Components of Effective Verification Processes

- Benefits for Lenders and Borrowers Alike

Understanding Car Title Loan Identity Verification

Car title loan identity verification is a crucial process that ensures lenders meet regulatory compliance standards when offering financial services through car title loans. This involves verifying the identity of borrowers by examining official documents, such as driver’s licenses or passports, and confirming their ownership of the vehicle listed on the title. It’s not just about confirming who you are; it also establishes the legitimacy of the collateral being used to secure the loan.

This verification process goes beyond a simple photo ID check. Lenders conduct thorough background checks, often including cross-referencing data from multiple sources like government databases and credit reports. For unique cases like semi truck loans or vehicle refinancing, additional documentation related to the vehicle’s condition and value may be required. This comprehensive approach ensures that both parties in the loan agreement are legitimate and protects lenders from potential fraud or risks associated with non-compliance.

Key Components of Effective Verification Processes

Effective identity verification for car title loans is a multi-faceted process that ensures compliance with financial regulations and safeguards against fraud. Key components include robust documentation checks, cross-referencing personal information, and utilizing reliable third-party databases. Verifying applicants’ identities involves more than just asking for government-issued IDs; it requires comparing data from multiple sources to ensure accuracy.

This rigorous verification process encompasses verifying the authenticity of documents like driver’s licenses or passports, confirming addresses through utility bills or bank statements, and cross-referencing social security numbers with official records. Additionally, understanding the loan requirements and assessing the applicant’s ability to repay, while considering interest rates and terms, is vital in ensuring responsible lending practices.

Benefits for Lenders and Borrowers Alike

Car title loan identity verification plays a pivotal role in ensuring that both lenders and borrowers benefit from this type of secured loan. For lenders, it fortifies the lending process by verifying the identity of potential borrowers, thus minimizing fraud and default risks. This step is crucial in maintaining compliance with financial regulations, which can have significant implications for the lender’s reputation and bottom line.

For borrowers, particularly those seeking Fort Worth loans, identity verification can streamline the title loan process. By providing accurate and authentic identification documents, borrowers establish their credibility and increase their chances of securing favorable loan terms. This mutual benefit fosters a transparent and mutually beneficial relationship between lenders and borrowers in the secured loan sector.

Car title loan identity verification is not just a regulatory requirement; it’s a critical component that enhances trust, mitigates risk, and ensures fairness in the lending process. By implementing robust and efficient verification methods, lenders can maintain compliance standards while offering accessible borrowing options to eligible borrowers. This dual benefit of improved operational integrity and better access to credit makes car title loan identity verification a game-changer in the financial landscape.